Being a student often means living on a tight budget, but that doesn’t mean you have to miss out on fun experiences. It might be difficult to manage finances while having a good time in college, but you can save money without sacrificing enjoyment if you use the right tactics.

Here are some useful and fun ideas to help you handle your money well so you can keep up with your friends, enjoy activities, and get the most out of your college years.

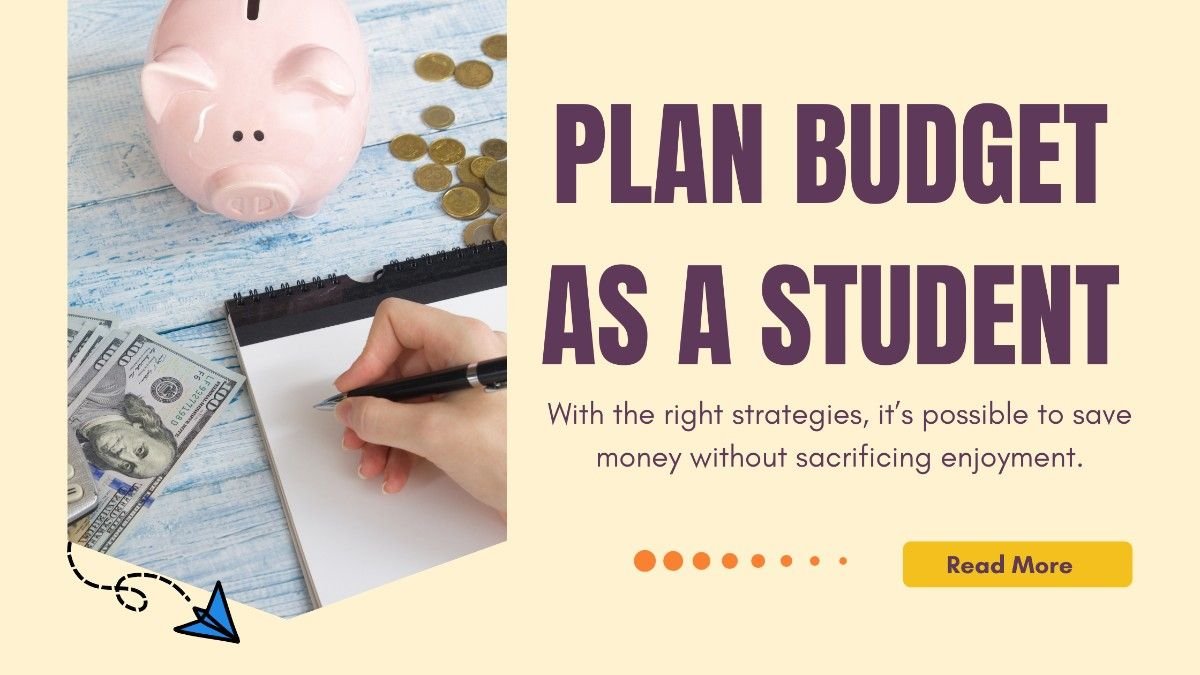

1. Create a Realistic Student Budget Plan

The foundation of financial stability as a student starts with effective budget planning. When you know exactly where your monthly money goes, you can make smart choices and avoid spending money you don’t need to.

Track Your Expenses

Start by keeping a month-long record of all your expenses. Sort them into necessities (such as food, rent, and transportation) and optional costs (such as dining out and entertainment). This can help you see where you can make savings and provide you with a clear picture of your spending patterns.

Set Clear Financial Goals

Having specific financial goals will help you keep focused on your financial objectives, whether they are emergency fund building, student loan repayment, or vacation savings. Set aside some money each month for savings, even if it’s just a tiny amount. These cost-cutting measures will eventually accumulate.

Prioritize Your Spending

Spending should be prioritized after you have an understanding of your costs. First things should always be essential. Set aside money for enjoyable activities that fit within your budget after your needs have been met. Setting priorities will help you have fun without going over budget.

2. Cut Costs on Daily Expenses

Your financial stability can be significantly impacted by the adjustments you make to your everyday spending. Here are a few strategies for cutting costs on regular expenses.

Opt for Student Discounts

Students can receive discounts from a wide range of establishments, including eateries, shops, leisure centers, and even internet services. Always keep your student ID with you, and before you buy, find out whether there is a discount available. Your monthly expenses might be greatly decreased by these savings.

Cook at Home

Regular dining out can easily drain your money. Try cooking at home instead. It’s not just less expensive, but also healthier for you. You may cut down on wasteful spending and minimize food waste by organizing your meals for the coming week and buying things appropriately.

Use Public Transportation

Utilize public transportation if you reside in a place that offers it instead of driving. Compared to owning a car, which entails costs for upkeep, insurance, and gas, it is less expensive. To further cut expenses, a lot of cities provide student passes for public transportation.

Limit Impulse Buying

One common method students spend money is through rash purchases. Think about whether you really need something or if you’re just buying it because you feel like it. One way to reduce wasteful spending is to give yourself a full day before making a purchase.

3. Find Affordable Entertainment Options

Spending a large amount of money is not necessary to have a good time. There are many ways to have fun without exceeding budget.

Take Advantage of Free Events

Various free events are available on most college campuses and in nearby areas, ranging from festivals and art exhibitions to movie evenings and concerts. Look for free or inexpensive entertainment choices by keeping an eye on the event calendar posted by your school and the neighborhood bulletin boards.

Join Clubs and Societies

A wonderful approach to meeting new people and participating in things you enjoy without breaking the bank is to join organizations and societies on campus. Many organizations plan free or inexpensive activities, trips, and seminars, offering a cheap and enjoyable means of meeting people.

Explore the Outdoors

One of the best sources of free entertainment is the natural world. Take your pals on bike rides, picnics, or hikes. Visit the parks, beaches, and trails in the area. In addition to saving money, you’ll gain from the health advantages of exercise and fresh air.

Host Budget-Friendly Gatherings

Invite friends around for a movie night, game night, or potluck dinner in place of going out. Since everyone can contribute in some way, it’s a cheap and enjoyable way to meet people. It’s also a more private space where you can connect with friends.

4. Smart Shopping and Spending Habits

You can save a lot of money over time if you learn proper buying habits.

Buy Second-Hand

Think about purchasing secondhand clothing, furnishings, and textbooks. Thrift stores, Facebook Marketplace, eBay, and other websites provide high-quality products at a far lower price than new ones. Look into whether you may share or borrow textbooks from the library.

Use Cashback and Coupon Apps

When you shop online, make use of applications like Rakuten, Honey, or Ibotta that offer cashback and coupons. With the discounts and cashback these apps provide, you can save money on things you would have bought otherwise.

Shop Sales and Clearance

Keep an eye out for clearance and sale items at all times. During holidays, back-to-school sales, and end-of-season sales, many retailers offer substantial discounts. During these sales, stock up on necessities to ultimately save money.

Consider Alternative Payment Plans

Alternative payment options, such as layaway or buy now, pay later (BNPL) services, should be taken into account for larger purchases. While these should be used cautiously, they can help you manage your budget by spreading out payments over time.

5. Save on Academic Expenses

Education expenses can add up quickly, but there are ways to save on your academic needs.

Rent or Buy Used Textbooks

The cost of new textbooks might be very high. Alternatively, consider renting or purchasing used textbooks. Websites such as Chegg, Amazon, and university bookstores frequently provide rental services or discounted secondhand books.

Utilize Free Online Resources

Students can access an extensive range of free online materials. You can get free access to a variety of knowledge, including study aids, video lessons, scholarly publications, and e-books. Websites that provide free instructional content include YouTube, Coursera, and Khan Academy.

Apply for Scholarships and Grants

Grants and scholarships are great methods to help pay for other educational costs like tuition. Take some time to look into and submit applications for scholarships that fit your needs. A lot of organizations, big and small, provide scholarships according to different standards.

Share Study Materials

Costs can be decreased by having classmates share study materials. For instance, you can create study groups where everyone provides resources, divide the cost of textbooks, or exchange notes. This cooperative method improves learning while simultaneously saving money.

6. Work Part-Time or Freelance

Earning extra money while you’re in school can help you relax about money issues and let you do more things without hesitation.

Find a Part-Time Job

Many students choose part-time jobs to pay for their education. Seek employment in school; positions like administrative support, study assistant, or library assistant can offer flexible hours to work around your class schedule.

Explore Freelancing Opportunities

Think about freelancing if you have a particular skill, like writing, coding, or graphic design. Through platforms such as Upwork, Fiverr, and Freelancer, you may market your services to customers all around the world. Working around your studies and earning money on your terms can be achieved through freelancing.

Participate in Paid Research Studies

There are many paid opportunities to take part in studies, focus groups, or surveys offered by colleges and research institutions. These could be a simple and time-efficient method to make some extra money.

Offer Tutoring Services

If you are good at a subject, you might want to think about tutoring other pupils. In addition to benefiting others, tutoring strengthens your knowledge and generates a consistent source of money.

7. Manage Your Debt Wisely

Students frequently have to take on debt, but it’s important to manage it carefully to prevent financial hardship after graduation.

Understand Your Student Loans

Ensure that you understand all the conditions associated with your student loans, such as interest rates, repayment schedules, and any grace periods. Understanding this information enables you to make repayment plans and stay out of debt traps.

Pay Off Credit Cards Monthly

Try to pay off the entire amount on your credit card each month to avoid paying hefty interest if you use one. Take care when you use credit, and don’t buy things that aren’t necessary.

Create an Emergency Fund

Having an emergency fund can keep you from taking on more debt in case you need to pay for something unexpected. In times of financial emergency, even a little savings can make a big impact.

Seek Financial Advice

Speak with the financial aid office at your school or a financial advisor if you’re not sure how to handle your debt or money. They can assist you in developing a strategy that fits your objectives and circumstances.

8. Make Saving a Habit

Saving regularly, even if you are on a tight budget, can help you become financially successful in the future.

Automate Your Savings

Each time you get paid, set up an automatic transfer to a savings account. Saving money regularly will help you gradually create a financial buffer, even if it’s only a small sum.

Save Spare Change

Save the extra money by investing it in apps like Acorns that round up your purchases to the nearest dollar. This is an easy way to save without even thinking about it.

Avoid Lifestyle Inflation

It can be tempting to spend more money as you start making more. Instead, make an effort to keep up your existing standard of living and use the extra money for debt repayment or savings.

Celebrate Milestones

Lastly, don’t forget to recognize and commemorate your financial achievements, such as hitting a savings target, paying off a credit card, or successfully adhering to a budget for a term. Acknowledging your accomplishments will inspire you to keep making wise financial choices.

Conclusion

As a student, you don’t have to give up fun and happiness to save money. You may get the most out of your college experience without going over budget if you plan carefully, have wise spending habits, and apply a little creativity. You’ll create money-saving habits that will serve you well even after graduation by putting these techniques into practice.

Always keep in mind that the secret is to strike a balance that suits you, one that lets you enjoy your time as a student while simultaneously positioning you for future financial success.